How To Pay For Long-Term Healthcare

Long-term care is something many people will have to address at some point, and you will have to figure out a way to pay for it.

Long-term care is something many people will have to address at some point, and you will have to figure out a way to pay for it.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

One of the best things you can possibly do for your family (and yourself) is to pre-plan your funeral.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

What is the best process when it comes to handling an inheritance? Lou Scatigna, CFP explains in this segment from The Financial Physician.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

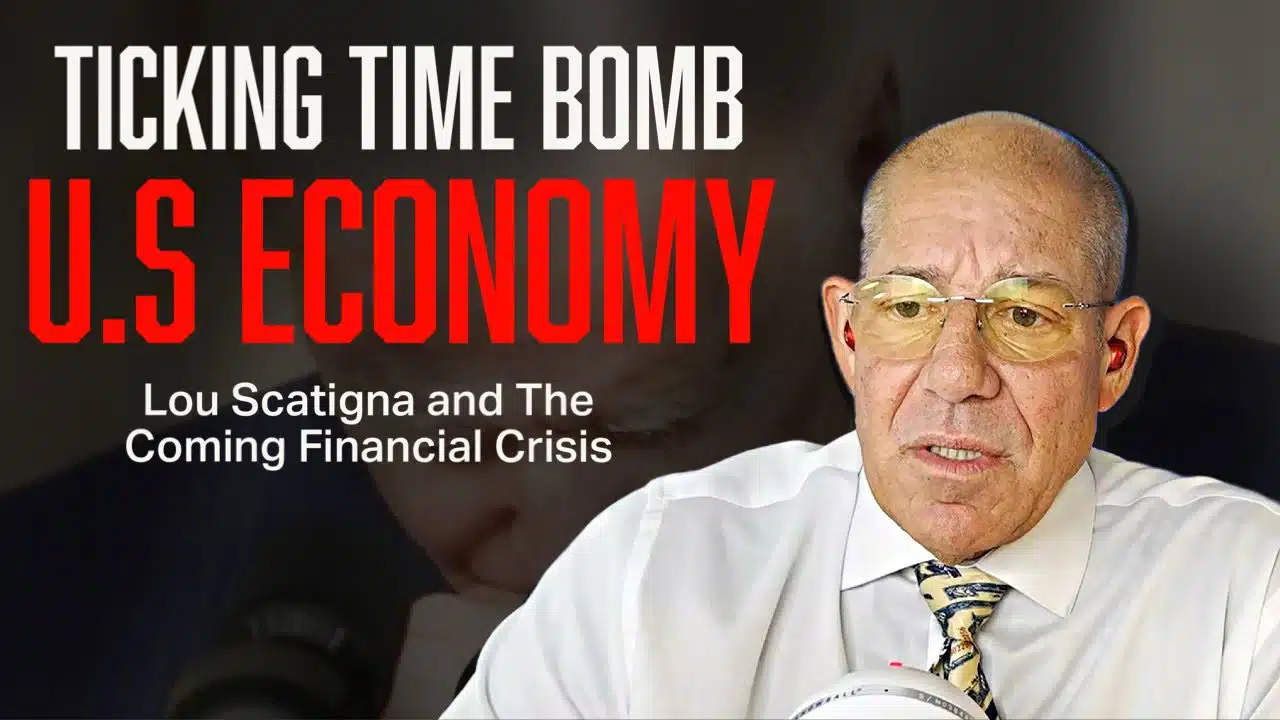

Lou Scatigna, CFP® was interviewed on RCT Network, where he discussed a variety of topics concerning the fragile state of the U.S economy.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

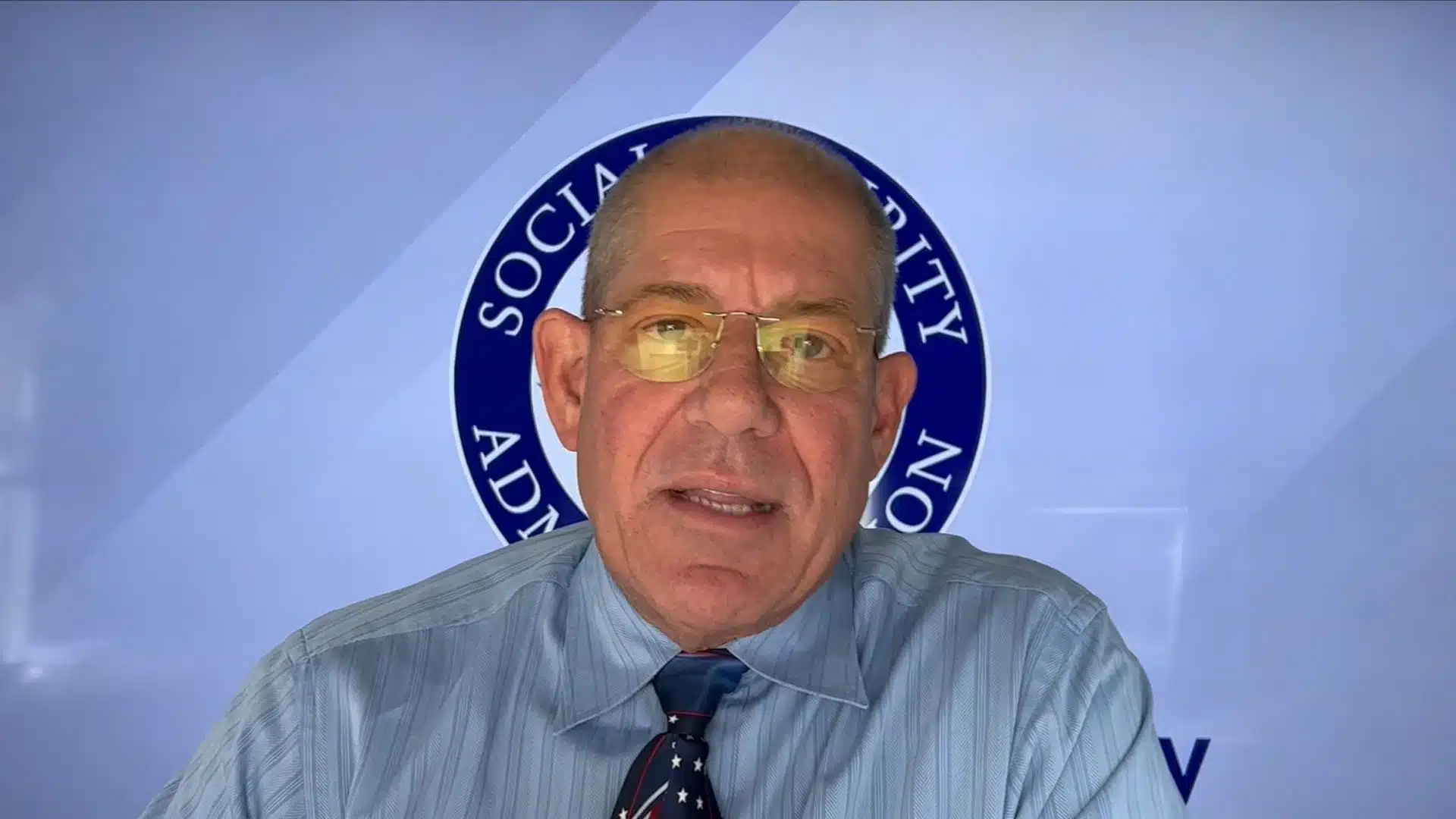

As many Americans get closer to the age of 65, they are starting to take a look at retirement options such as Social Security.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

How we buy cars, how we finance them and how long we keep them makes a huge difference when it comes to our financial health.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.