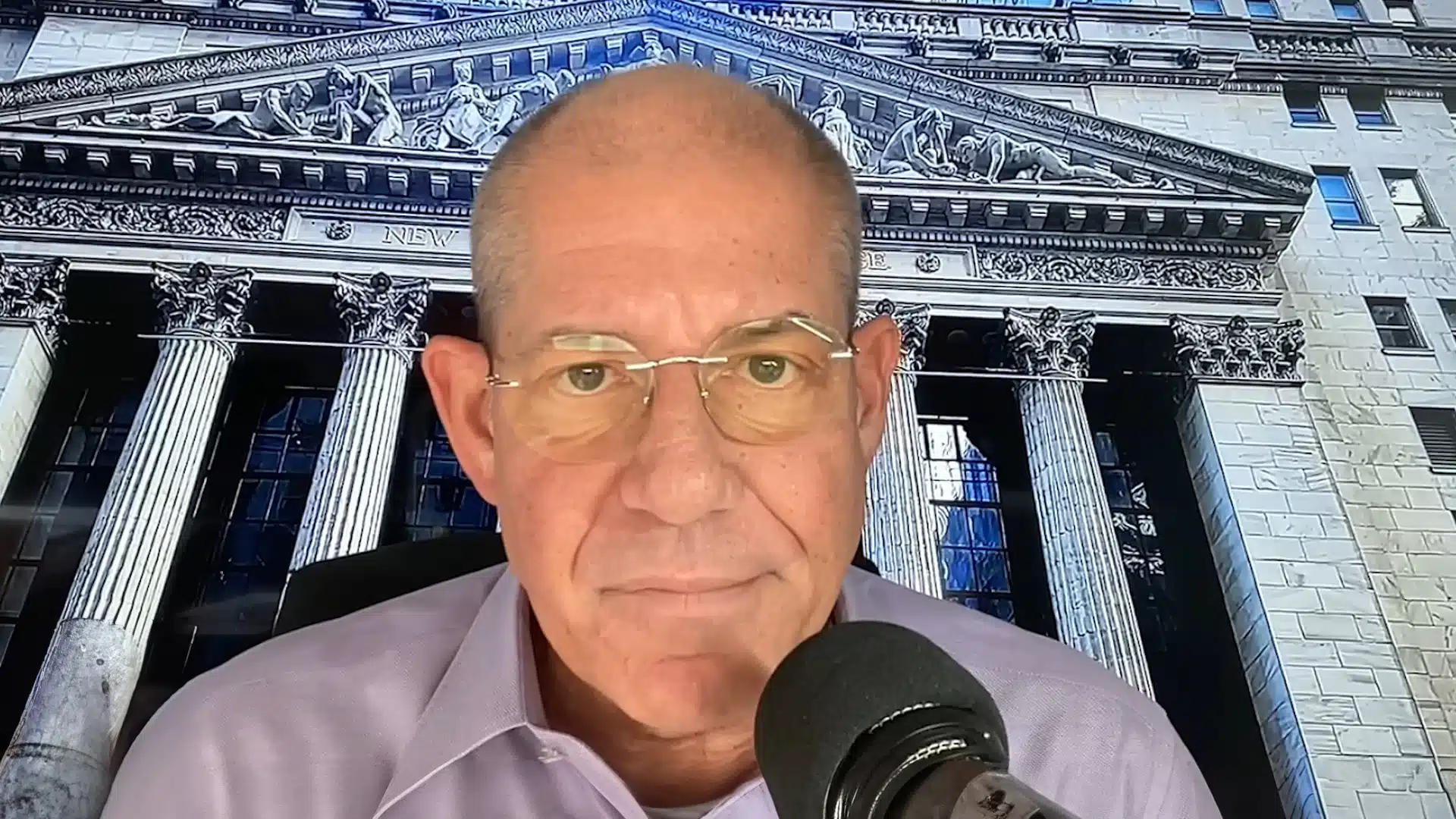

New Podcast Episode Now Available

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Lou Scatigna, CFP conducts an exclusive interview with Andy Schectman, President and CEO of Miles Franklin Ltd. Precious Metals.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Lou Scatigna, CFP speaks to 40+ year financial veteran Peter Grandich about money, markets, politics and a variety of other topics.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.

Most investors have an understanding of the stock market, but even experienced ones may not have a full grasp of how the bond market works.

Listen to The Financial Physician, where Lou Scatigna, CFP® talks money, markets, politics and other topics that affect your life.